Optical Communications on the Rise

Market Overview of Optical Communications in the Post-Epidemic Era

Since 2021, in the post-epidemic era, the surge in traffic demand has driven service providers to accelerate network upgrades. With the rapid increase of 5G users, data traffic continues to expand, and capital expenditures in cloud data centers are expected to rise steadily. Meanwhile, 400G optical modules are entering large-scale deployment. In the first half of 2021, overseas mergers and acquisitions in the optical communications sector occurred frequently, as industry giants targeted future growth areas and core technologies. The upstream communications market overseas is gradually shifting toward an oligopolistic structure. At the same time, global chip shortages may slow the construction pace of optical fiber and 5G networks, creating both opportunities and challenges for the market.

Industry Performance and Growth Trends

By the end of August 2021, most listed companies in the optical communications industry had released their half-year financial results. According to ICC statistics, the industry as a whole showed a positive growth trend. In the first half of 2021, more than 100 listed domestic and international companies in the communications industry recorded total revenue of US$1,363.138 billion, compared with US$1,102.751 billion in the same period of 2020—representing a year-on-year increase of 23.6%. The gross profit margin was 52.97%, remaining largely stable, while the net profit margin reached 18.01%, showing a clear upward trend.

Sub-Sector Dynamics

Cloud Services & Internet Content Providers (ICP):

Expenditures continued rapid growth in the first half of 2021. Rising traffic demand fueled the IDC industry, boosting ICP revenues and accelerating data center investment. According to ICC, ICPs achieved total revenue of US$80.408 billion in the first half of 2021, up 37.57% from US$58.283 billion in the same period of 2020. Their gross profit margin was 50.36%, slightly down 0.61 percentage points year-on-year, while net profit margin increased to 21.82%, up 5.56 percentage points.

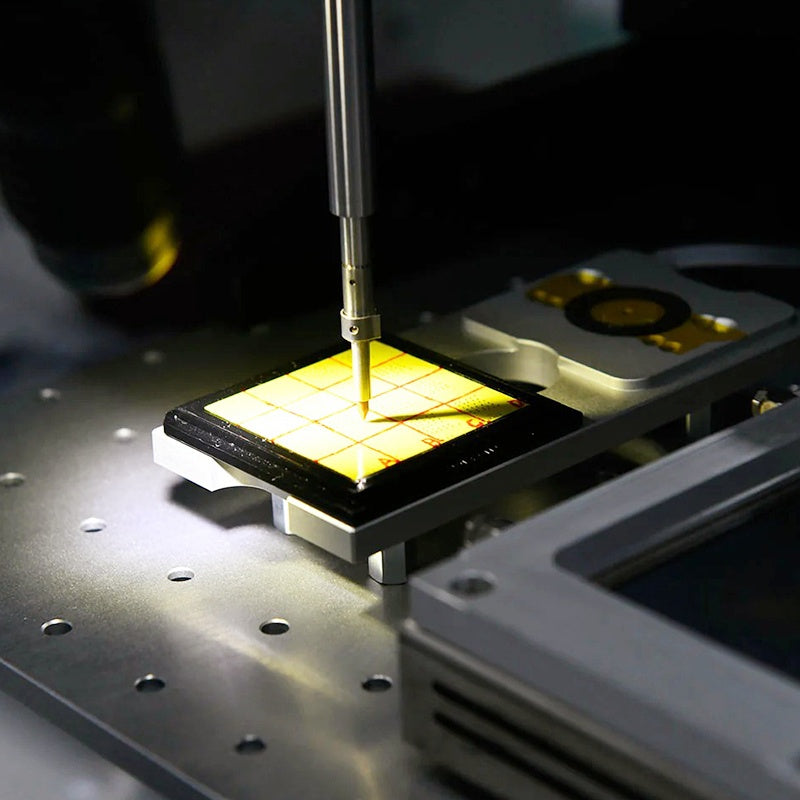

Semiconductors & Chips:

Against the backdrop of COVID-19, U.S.–China tech competition, and supply chain disruptions, the semiconductor industry underwent significant restructuring. In the first half of 2021, frequent mergers and acquisitions reshaped the market landscape. Global chip vendors reported total revenue of US$20.761 billion, up 17.91% year-on-year, with a gross profit margin of 55.54%. Net profit margin reached 22.43%, an impressive year-on-year increase of 11.85%. Rising chip prices and supply shortages were the main drivers behind this strong profitability.